Glad you clicked on that title full of acronyms because it’s been another CRAZY week in the Web3 ecosystem, from OKB moving to pNFT to reclaiming lows, USDC crashing & 2008 even called the phone with a second coming of bank bailouts for SVB (kinda). It can never be a quiet week in crypto, even on a Sunday!

That’s why you’ve got The Review keeping you UP-TO-DATE on the latest from the industry. Before we scroll down the article, tap the Subscribe button to support for free:

Today covered in The Review:

WTF is pNFTs?

Silicon Valley’s Bank

USDCrash

📎WTF is pNFTs?

NFTs have changed a lot since their inception, but their applications are not fully realized. Metaplex released the main NFT standard used around the Solana ecosystem but pNFTs are the next iteration: Programmable NFTs.

New NFT standards require a migration process & my beloved Pesky Penguins fam brought this to a vote on recently. I listened into the spaces recording which the developer NFP presented much of this information. You can tap in to listen while the recording’s available here.

Early collections such as Pesky Penguins didn’t have all the bells & whistles available in later editions of the Candy Machine, such as Metaplex’s “collection” tag NFTs to indicate a set. These upgrades came over time, none threatening the previous versions.

Then NFT royalties became optional…

After optional royalties & the search for solutions that followed, Metaplex created a second standard: the pNFT.

pNFTs are more configurable, making burning, creating new editions, delegating authority like locks or transfers, royalty nonpayment all optional according to the ownership’s dictation.

When compared to previous standards, the HOLDER by default holds less freedoms over the NFT in favor of the CREATORS’ vision. For example: a founder launching a collection saying “I don’t want you to burn 1 of the total 5000 NFTs so I set it so you can’t ever.”

In general, the pNFT additions aren’t a bad thing, but it IS important to understand when buying.

🏧The Valley’s Bank

Silicon Valley is home to developers & dreamers innovating on the cutting edge of VC-owned companies looking to make scalable solutions en masse. From companies like Apple & Google to Shopify & DropBox and more, this region of California fund & produce some of the biggest investment vehicles on the market…

And with all that investment, the money needs to stored someplace…

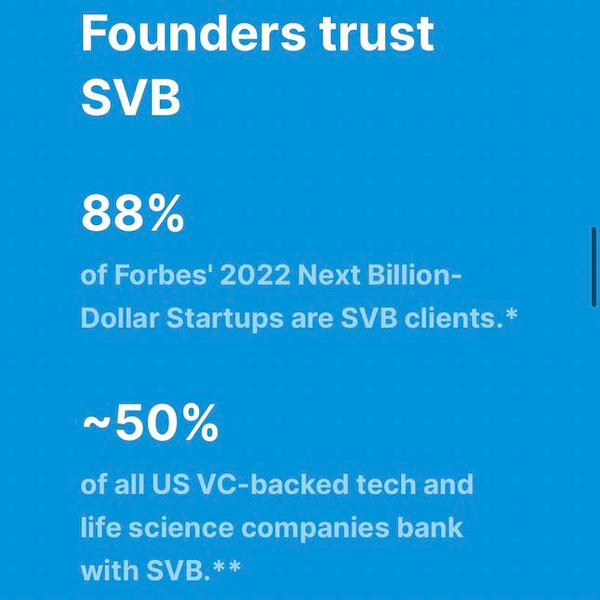

Enter Silicon Valley Bank, who’s success in real estate carried it to a lucrative position come the Dot-Com Bubble, catapulting the bank’s support through to becoming a large servicer in many startups, garnering trust to holding over 50% of all US VC-backed tech and life science companies.

When the market shifted, many companies in the tech world began to suffer. Seeing even FAANG companies laying off in waves, it is not hard to see how this bank fared similarly.

On March 10th, 2023 examiners from the Federal Reserve & FDIC discovered inadequate solvency for their deposits.

The effects of this are still yet to be seen, but even inside crypto’s investment bubble we saw USDC slip…

💰USDC: Gone for a Dip

In the aftermath of the Fed’s discovery, we saw Circle & its stable coin $USDC see depths of 82 cents per dollar. This was talked about ENDLESSLY on twitter as everyone was trying to figure out what was happening & how this compares to LUNA-UST depeg - FYI, it doesn’t compare.

If you were smart & didn’t doubt yourself like I did, you would’ve bought up every dollar you could at the 10-15%+ discount. I even heard some people could even buy & redeem USDC for USD in your Robinhood Buying Power.

Crazy how these situations of uncertainty can provide the biggest returns. Just shows that these opportunities are always out there, so stay educated & keep an eye out for the next.

🔄Plan & Pivot

After all this, we even got to see that Silicon Valley Bank depositors got BAILED OUT by the Federal Reserve, ensuring the almost 90% of Next Billion-Dollar Startups have access to funds when they open Monday. While these companies provide massive value on the future health & continued innovation in the market, this burden & mismanagement falls onto the taxpayer’s shoulders.

So how does this affect us? I found this short thread following this announcement:

Thank you for reading, now let’s finish off with a quote:

Write your future in pencil…Be prepared. Plan for the future. But also be ready to pivot if a new opportunity comes your way, or if you discover something that was not part of the master plan– makes your heart sing and your mind buzz with possibilities.

— Michele Norris

Caleb🧣

Nice graphics... When can I shill mine too 😢